Effortless loan compliance for banks and SMEs

Effortless loan compliance for banks and SMEs

No reminders. Unclear expectations. Reports often arrive late.

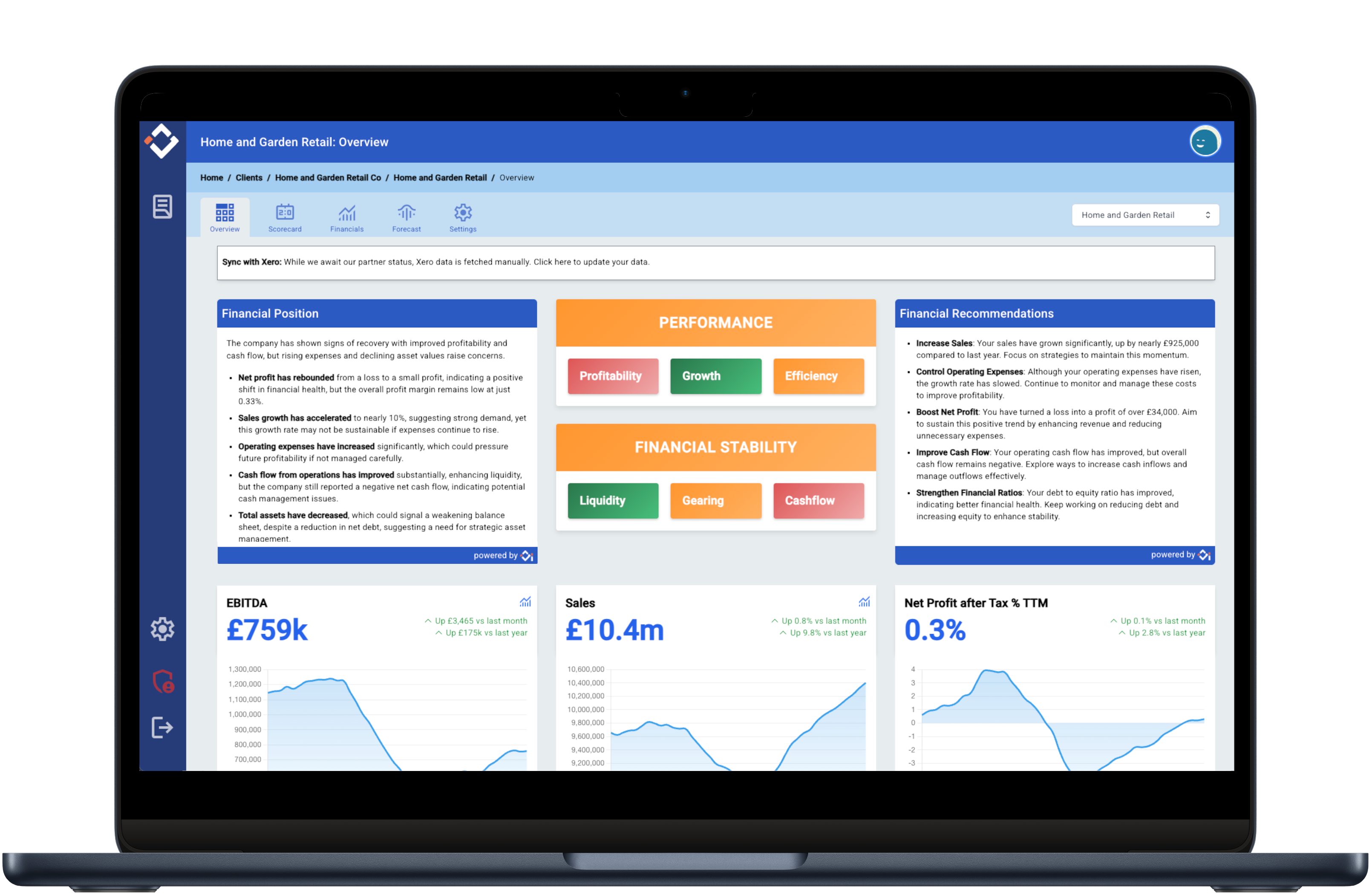

Spot potential breaches before they happen with integrated financial forecasting and alerts

And we're looking for the right pilot partner.

We're currently inviting UK banks to co-develop the future of SME loan compliance with us.

Actuly's dashboard

We're currently inviting UK banks to pilot Actuly and help shape the future of SME loan compliance.

Or if you’re just curious to follow our progress, sign up for early access and updates — we’ll keep you in the loop.